![]()

Introduction

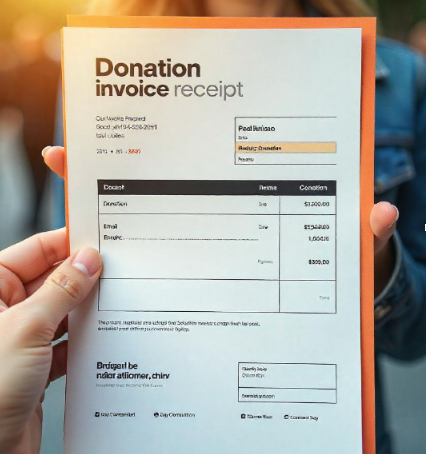

Donations play a crucial role in supporting charitable organizations, and proper documentation is essential. A donation invoice receipt template simplifies the process of acknowledging contributions while ensuring legal compliance. Whether you're a nonprofit, church, or charity, issuing well-structured receipts helps maintain transparency and build trust with donors.

What is a Donation Invoice Receipt?

Every donor receives what is essentially a receipt of invoice for their donation, which forms an admission to present it as formal proof of the charitable contribution made by the donor. A donation receipt contains relevant details like name and address of the donor, amount donated, and the organization which it is a registered tax-exempt organization. Unlike a standard invoice, a donation receipt will not ask for any payment but will give an acknowledgment of a voluntary gift.

Why Are Donation Receipts Important?

Ways to Deduct Your Charitable Contributions

Donors can only qualify for tax deductions if they have the proper paperwork in hand. A charitable donation receipt, therefore, acts like a key to opening the door for tax authorities for claiming tax deductions.

Transparency for Nonprofit Organizations

Standardized receipts provide authenticity and information to the donor by assuring the donor of the instincts and confidence build in the organization.

Legal Requirements

Most often, governments require charities to issue a receipt for contributions exceeding a certain amount.

Key Elements of a Donation Invoice Receive

Organization Name: The full legal name of the nonprofit.

Organization Contact Details: Address, phone number, and email.

Donor Information: Name, address, and contact details.

Amount Donated: The exact value of the contribution.

Date of Donation: When the donation was made.

Payment Method: Cash, check, credit card, or online transfer.

Tax-Exempt Status: The organization’s registered tax ID.

Unique Receipt Number: A sequential identifier for tracking purposes.

Signature: Authorized representative’s signature.

How to Create a Donation Invoice Receipt

Online Templates: Websites offering customizable templates.

Accounting Software: QuickBooks, Xero, and FreshBooks automate the process.

Best Practices for Issuing Donation Receipts

Ensure accuracy in details.

Send receipts promptly to donors.

Keep digital and paper records for future reference.

Common Mistakes to Avoid

Missing tax-exempt information.

Providing incorrect donor details.

Not including a unique receipt number.

Free Donation Invoice Receipt Templates

Many websites offer free donation receipt templates, including:

Microsoft Office Template Gallery

Google Docs Template Library

Nonprofit organization websites

How to Use a Template Effectively

Digital vs. Paper Donation Receipts

Environmentally friendly

Easier record-keeping

Legal Considerations for Donation Receipts

FAQs about Donation Invoice Receipts

Yes, tax authorities require official donation receipts for claims.

The receipt should include donor details, donation amount, date, tax-exempt status, and receipt number.

Yes, but specify the donated item’s estimated value rather than a monetary amount.

Nonprofits should retain records for at least 3-7 years.

Websites like Microsoft Office, Google Docs, and nonprofit portals provide free templates.